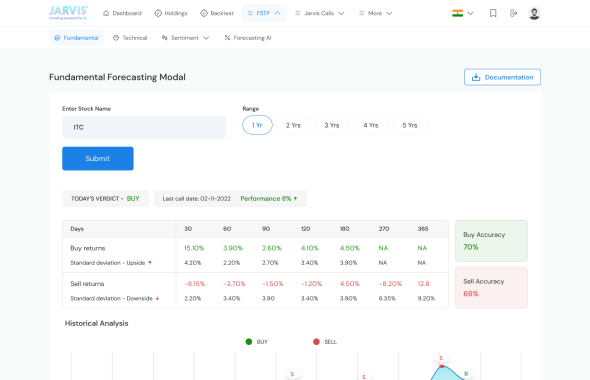

Fundamental

It is designed to carry out fundamental analysis of stocks and offer recommendations

based on proprietary models developed by JARVIS. This tool also offers a comprehensive

view of the stock journey over a period of 5 years along with the efficacy of the

recommendations.